Trusts, Wills & Probate

Empowering individuals and families with lifetime roadmaps for the preservation and protection of their future, assets and legacies.

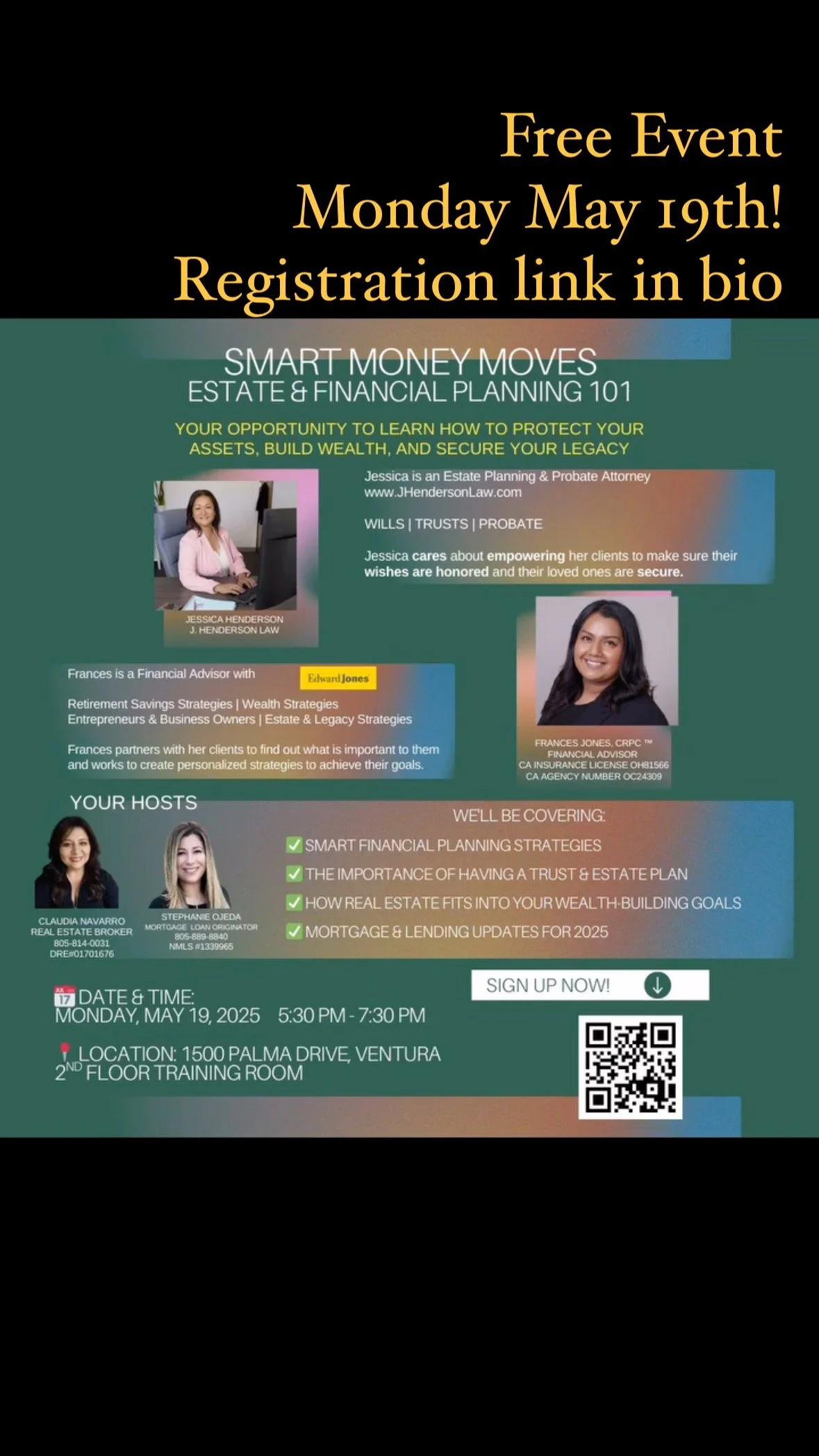

California Estate Planning and Probate Attorney

At J. Henderson Law, each matter is approached with a commitment to educating clients about estate planning, probate, family dynamics, and range of outcomes, to ensure the wisest course of action and the best possible outcome.

The mission is to serve my community and fellow California residents as an exceptional trusted advisor that everyone deserves, without gimmicks or complexity. I strive to make the experience feel as if it was “easy” for the client, and embody the value that my expertise provides. - Jessica Henderson

Estate planning provides peace of mind and support for many families and individuals from young adults to the elderly, and even beloved pets!

But that’s not all, families can avoid costly and lengthy probate, allowing for a smoother transition of assets and less emotional turmoil.

At J. Henderson Law we implement effective estate planning methods which minimizes tax implications, ultimately preserving more wealth for your family.

Who Does Estate Planning Benefit?

How can we help you?

-

Home Owners

We assist clients to ensure their wishes regarding asset distribution, including their homes and investment properties, are fulfilled after their passing.

-

Seniors

We help manage assets and ensure your wishes are honored along with your long-term financial and familial goals.

-

Business Owners

Protecting business equipment, leases, payroll and more can by done with strategic estate planning.

-

Real Estate Investors

We help investors prepare a plan to maintain wealth and grow it for their future generations.

-

Married & RDP Couples

Our estate planning service provides personalized strategies to help you protect your assets and ensure your wishes are fulfilled for your spouse and loved ones.

-

Individuals

With our personalized service, we ensure your wishes are respected and your legacy passes on.

-

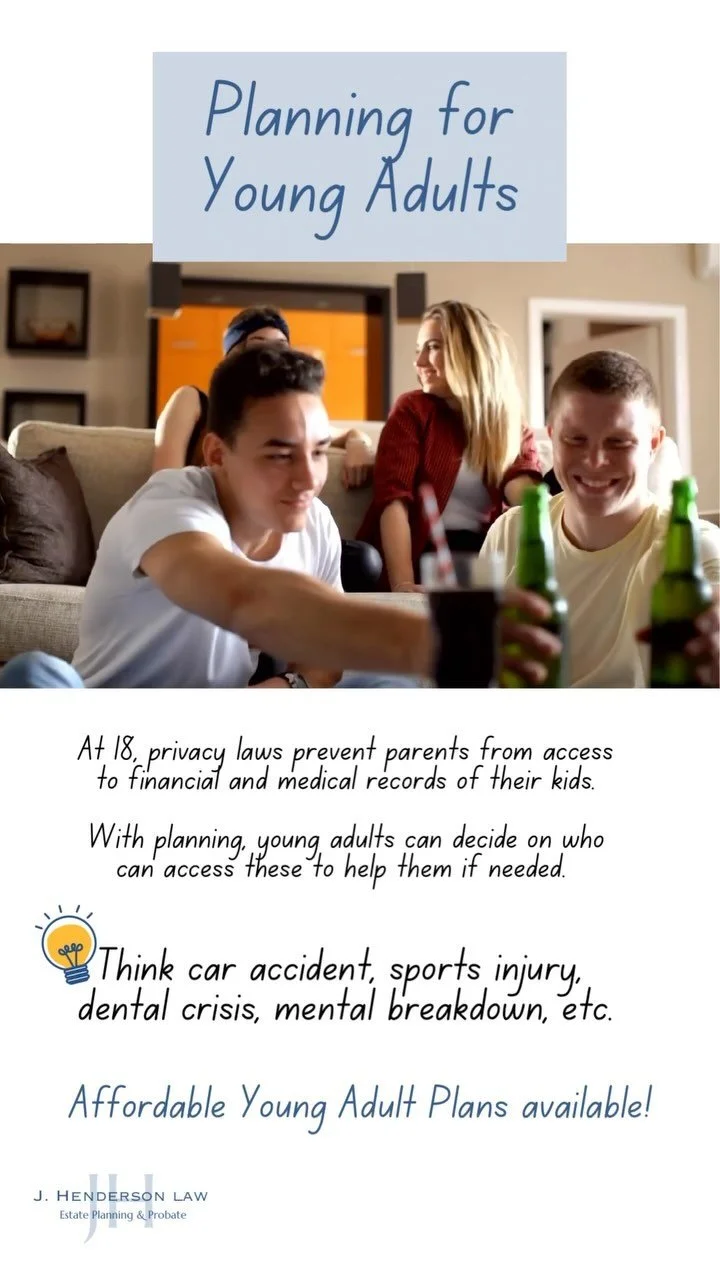

Young Adults

Our services include guiding college-aged individuals with this transitional period, empowering them on making informed decisions about their future, and providing tools they need to advocate for themselves effectively.

-

Special Needs Children

Our special needs planning services help you secure your loved one’s future by creating customized legal strategies, including special needs trusts and guardianship arrangements.

-

Probate

Losing a loved one is difficult. Navigating through probate does not need to be. We will be by your side from beginning to end.

Read the Blog

Let’s Connect on Instagram

GET STARTED